Homeowners Still Have Positive Equity Gains over the Past 12 Months

If you’re a homeowner, your net worth got a big boost over the past few years thanks to rapidly rising home prices. Here’s how it happened and what it means for you, even as the market moderates.

Equity is the current value of your home minus what you owe on the loan.

Because there was a significant imbalance between the number of homes available for sale and the number of buyers looking to make a purchase over the past few years, home prices appreciated substantially.

And while home price appreciation has moderated this year, and even depreciated slightly in some overheated markets, that doesn’t mean you’ve lost all the equity you gained during the pandemic frenzy.

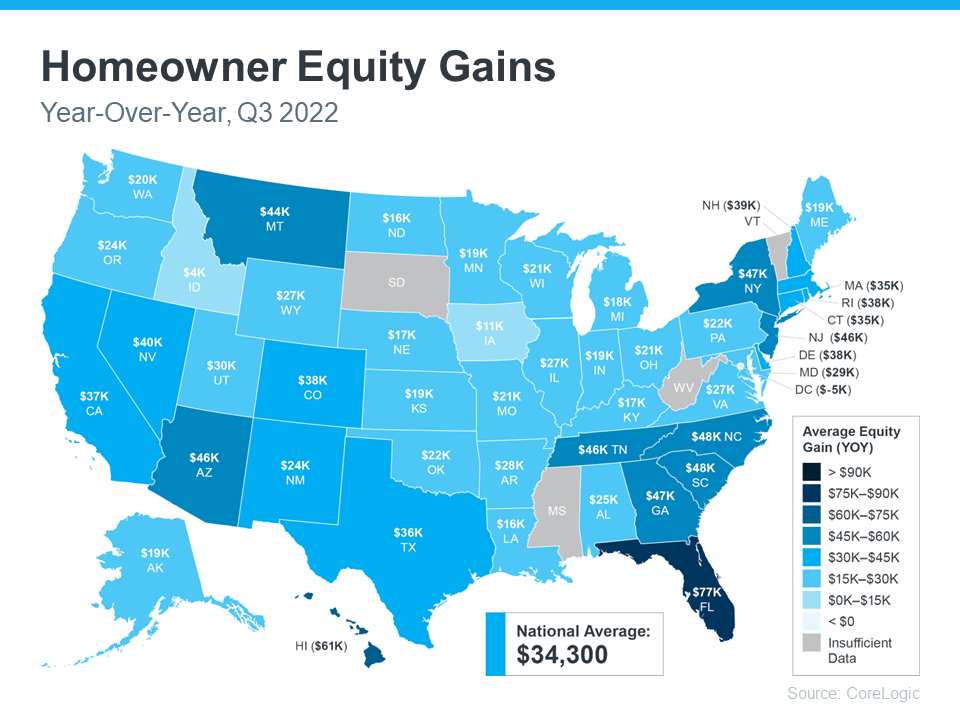

To prove you still have equity you can use, the latest Homeowner Equity Insights from CoreLogic finds the average homeowner equity has actually grown by $34,300 over the past 12 months.

That’s right, despite the headlines, the average homeowner still gained positive equity over the last year in just about every market. While the gains aren’t as dramatic as they were in the previous quarter due to home price moderation, they’re still significant. And if you’ve been in your home for longer than a year, chances are you have even more equity than you realize.

While that’s the national number, if you want to know what happened over the past year in your area, look at the map below from CoreLogic:

Why This Is So Important Right Now

While equity helps increase your overall net worth, it can also help you achieve other goals, like buying your next home. When you sell your current house, the equity you’ve built up comes back to you in the sale, and it may be just what you need to cover a large portion – if not all – of the down payment on your next home.

So, if you’ve been holding off on selling because you weren’t sure what the headlines meant for your bottom line, rest assured you’ve still gained equity in recent years, and it can help fuel your move.

Bottom Line

If you’re planning to make a move, the equity you’ve gained over time can make a big impact. To find out just how much equity you have in your current home and how you can use it to fuel your next purchase, let’s connect.

For more information follow this link https://bit.ly/3V7oirz

Whether you are relocating from around the world or from just around the corner, allow Natascha Honc to take the stress out of buying and selling real estate. As a Coldwell Banker Realty full-service real estate agent, Natascha has a vast, professional team ready to support you. The real estate market can be complicated, but with professionalism, patience, and respect, Natascha Honc will guide you every step of the way. Let’s connect today!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link