Planning to Retire? It Could Be Time To Make a Move.

Planning to Retire? It Could Be Time To Make a Move.

Planning to Retire? It Could Be Time To Make a Move.

If you’re thinking about retirement or have already retired this year, you may be planning your next steps. One of your goals could be selling your house and finding a home that more closely fits your needs.

Fortunately, you may be in a better position to make a move than you realize. Here are a few things to think about when making that decision.

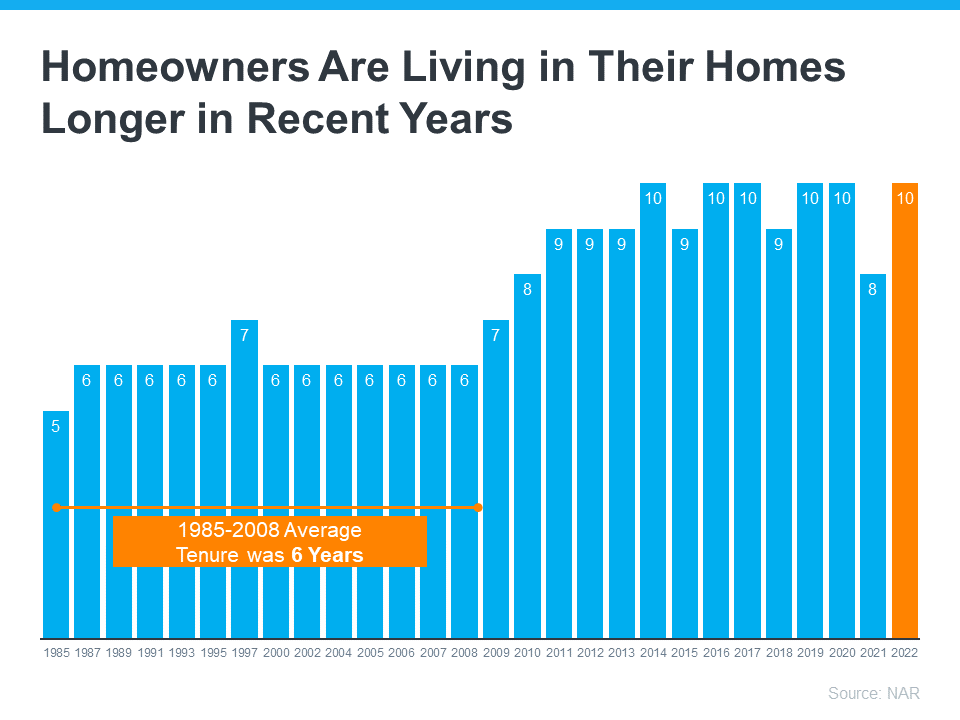

Consider How Long You’ve Been in Your Home

From 1985 to 2008, the average length of time homeowners typically stayed in their homes was only six years. But according to the National Association of Realtors (NAR), that number is rising today, meaning many homeowners are living in their houses even longer (see graph below):

When you live in a home for a significant period of time, it’s natural for you to experience a number of changes in your life while you’re in that house. As those life changes and milestones happen, your needs may change. And if your current home no longer meets them, you may have better options waiting for you.

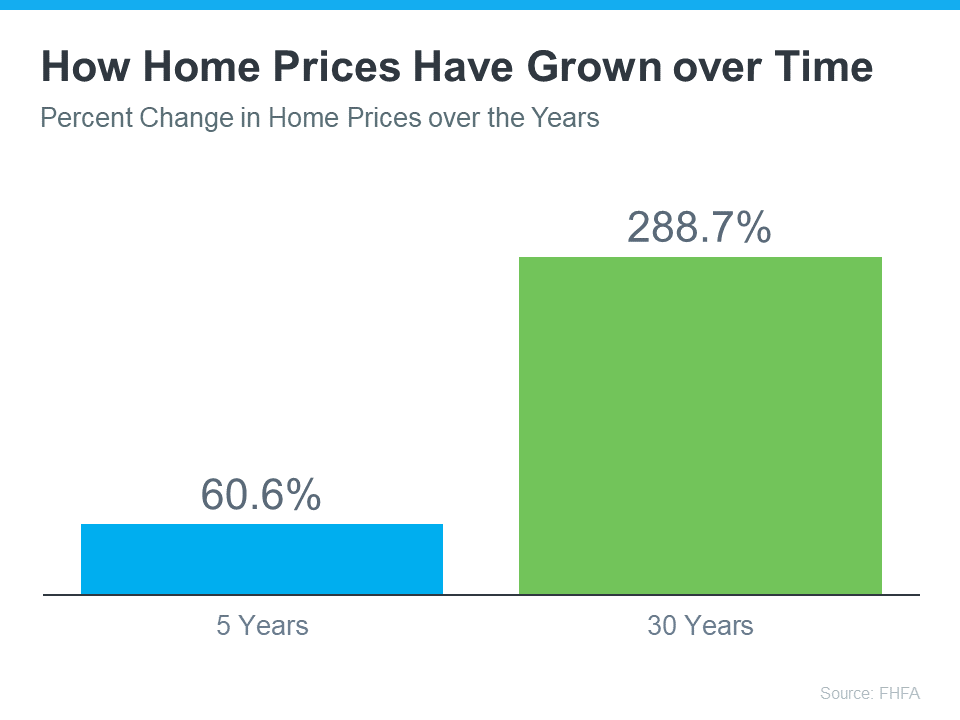

Consider the Equity You’ve Gained

Additionally, if you’ve been in your home for more than a few years, you’ve likely built up significant equity that can fuel your next move. That’s because the longer you’ve been in your home, the more likely it’s grown in value due to home price appreciation. Data from the Federal Housing Finance Agency (FHFA) illustrates that point (see graph below):

While home price growth varies by state and local area, the national average shows the typical homeowner who’s been in their house for five years saw it increase in value by over 50%. And the average homeowner who’s owned their home for 30 years saw it almost triple in value over that time.

Consider Your Retirement Goals

Whether you’re looking to downsize, relocate to a dream destination, or move so you live closer to loved ones, that equity can help you achieve your homeownership goals. NAR shares that for recent home sellers, the primary reason to move was to be closer to loved ones. Plus, retirement played a large role for those moving greater distances.

Whatever your home goals are, a trusted real estate advisor can work with you to find the best option. They’ll help you sell your current house and guide you as you buy the home that’s right for you and your lifestyle today.

Bottom Line

Retirement can bring about major changes in your life, including what you need from your home. Let’s connect to explore your opportunities in our local market. For more information follow this link https://bit.ly/3hy8RuK

Whether you are relocating from around the world or from just around the corner, allow Natascha Honc to take the stress out of buying and selling real estate. As a Coldwell Banker Realty full-service real estate agent, Natascha has a vast, professional team ready to support you. The real estate market can be complicated, but with professionalism, patience, and respect, Natascha Honc will guide you every step of the way. Let’s connect today!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link